Construction in Queensland. How last year affected the Construction Industry and what can we expect in the next four years.

Last year was unprecedented for all businesses, and the Construction Industry was by no means exempt from these challenges. Despite being recognised as an essential service during the COVID-19 pandemic, feelings of uncertainty, restricted working conditions and restrictions for international workers means that the flow-on effects will be felt for many years to come across all businesses. Recent predictions are claiming a boom in the Construction Industry over the next four years similar to the rise of construction seen in 2014. However, with global travel restrictions still in place, what will this increase in Construction mean for businesses looking to hire skilled workers as the Australian economy re-builds?

Last Year in Review

Beginning with ravaging bushfires that made their way through the Southern States and followed closely by the series of lockdowns sparked by the global COVID-19 pandemic, there was a new level of uncertainty in our everyday lives. This affected every element of how we lived – our ability to go out, see family and friends and how we were able to trade and work.

With a new digitalised work environment, zoom meetings and elbow-bumping becoming the norm for many businesses. Lockdowns resulted in a flow-on effect of uncertainty around local market movements. This, not surprisingly, resulted in a large drop in new hires for the majority of businesses as some used the COVID-19 situation as an excuse to remove underperforming staff while keeping critical or valued members of their teams with the Government assistance that was on offer during this period. In many industries, this resulted in a very saturated employee market, with few job positions available. However, the construction industry was, for the most part, an exception to some of these stresses as the industry was deemed essential and was able to continue trading. Many organisations experienced a boost in demand for products and services.

In the recruitment industry, the high amounts of uncertainty meant that by the second quarter of 2020, agencies like Barclay saw large decreases in their activity. We saw the biggest drop in our recruitment activity history, outweighing both the Global Financial Crisis and the 2013 Mining Collapse. However, once the lockdown ended and Queensland businesses were able to begin trading more consistently again, the recruitment trends changed dramatically. The result – from June to December 2020 was exceptionally busy for many recruiters, especially those within the Construction, Engineering and Manufacturing sectors.

The Construction Industry Now

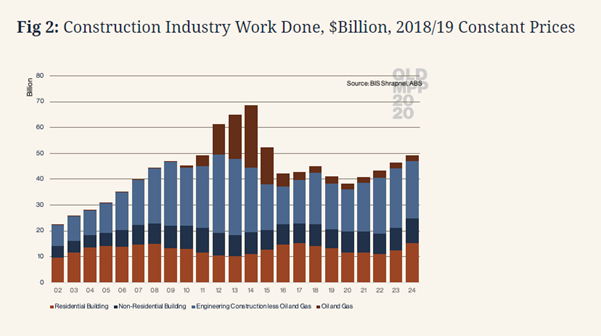

With Queensland now returning to more typical pre-COVID conditions, both State and Federal Governments have fast-tracked funding and approvals for major construction projects to stimulate this section of the economy. The graph below, released by Queensland’s Major Projects Pipeline and updated in October 2020, shows the trends and predictions of the Construction Industry in Queensland from 2002 to 2024.

As shown in the graph, $68billion in major project work was completed in 2014, making 2014 a record year for the industry. These results were heavily reliant on the Oil and Gas infrastructure being completed during this time which made up almost 30% of the total works shown. However, many of the contractors engaged in this work were international organisations (predominately from the US or Europe), which resulted in a low impact for local contractors.

In the 2023 prediction, the same high levels of construction in all areas except the oil and gas sectors are expected. This could be higher still with inaccurate data from contractors and suppliers in the residential sector meaning that the uplift in this area is going to be significantly more positive than the current forecasting suggests. Further to this, if Queensland is successful in the bid for the 2032 Olympics then this will also add to the construction taking place in the lead-up to the event.

There are several reasons noted for the predicted growth shown. As previously mentioned, both the State and Federal Governments have fast-tracked funding and approvals for major construction projects to stimulate the Construction section of the economy. This, alongside relaxed lending criteria, the low cost of borrowing and changes to Federal Government guarantees for commercial finance will all contribute to the predicted growth. Furthermore, residential construction is in high demand following on from the effects of lockdown and a move from high-density living, such as units and townhouses, to larger spaced suburban houses. In contrast, there are still a high number of work-from-home employees that are continuing with this working arrangement post-lockdown resulting in a decrease in the demand for office space. Although this could adversely impact non-residential building construction in the short to mid-term, Government spending on infrastructure areas such as correctional facilities, hospitals, education and transport should be more than enough to offset this.

What Does this mean for Construction Workers?

All in all, the construction sector is looking very positive in Queensland over the next four years with increases in commercial, residential and engineering construction forecasted. Traditionally, we have looked abroad to find skilled migrants to fill the needs of our economy. However, due to current restrictions on international travel, this is not an option, at least in the shorter term. Furthermore, overseas students studying engineering in Queensland who would ordinarily be due to step into the workforce once graduated, are for the most part studying remotely and unable to return to Queensland for employment opportunities. As a result, we are expecting a significant strain on the Queensland skilled workforce to service these predicted projects.

Unless Australia’s international borders open, the increase in major construction activity and the reduction of talent pools for skilled employees is set to drive significant wage pressure and potentially increase build costs. The result – a very saturated employee market with an overflow of projects.

If you are wanting to find out more about the employment market in Queensland or are after assistance in workforce planning, please reach out to Barclay via email at [email protected] or on 07 3211 1433.